Was Rocket Lab's Electron worth it?

Modelling Electron's financial performance

Of the 100+ small-lift rockets to have been announced, only one has seen sustained success – Rocket Lab’s Electron. Electron has launched 10 times this year and has launched successfully 27 times since its last failure in 2023. Meanwhile, Rocket Lab’s stock has skyrocketed. At publication, the market values $RKLB around $22B, up ~800% year over year. Rocket Lab is printing money for its investors, but has its flagship rocket printed internally?

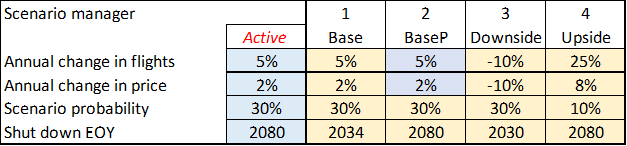

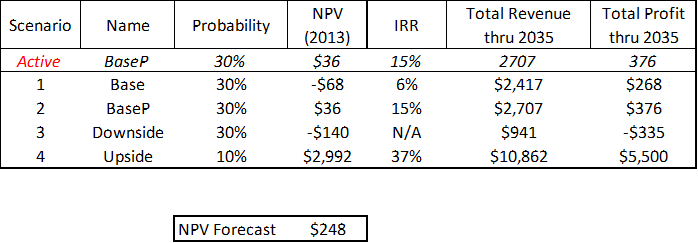

In this post, I attempt to piece together Electron’s costs and revenues from publicly available information to determine a plausible internal rate of return (IRR) for the program. I also project future cadence and profitability across four scenarios and derive lifetime net present values for the Electron program ranging from -$140M to $3B. This is a huge range as I consider somewhat extreme upside and downside cases! I project Electron to have a lifetime NPV of $248M.

Electron performance to-date

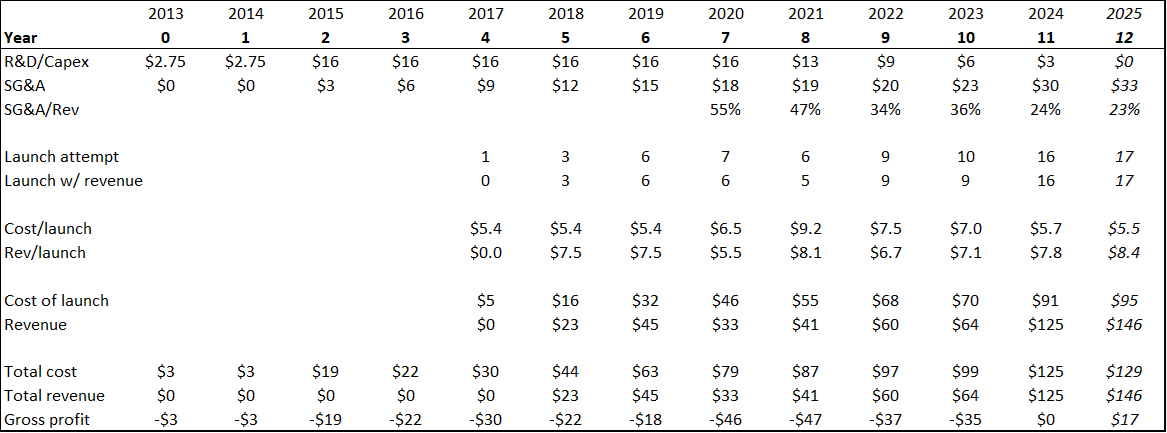

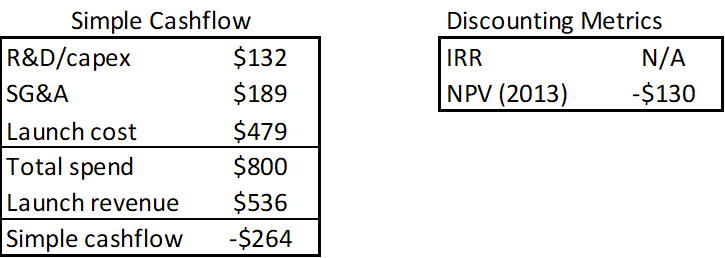

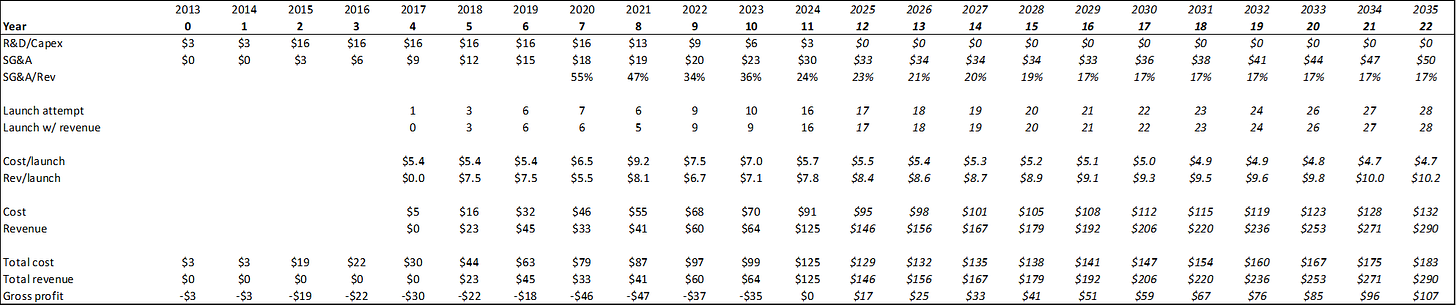

I’ll give results first then dive into methods and sources. Italics indicate projections and all figures are in millions of USD. Model and results below:

Electron has not broken even to-date. Total costs ($800M) exceed revenue ($536M).

R&D and capital expenditures

In Oct 2020, CEO Peter Beck claimed Rocket Lab spent “less than $100M on development and a total of $180M to date including building 3 launch pads, 4 acres of production facilities, 2 mission controls, 14 flights, and accounting for my mission to Venus”.

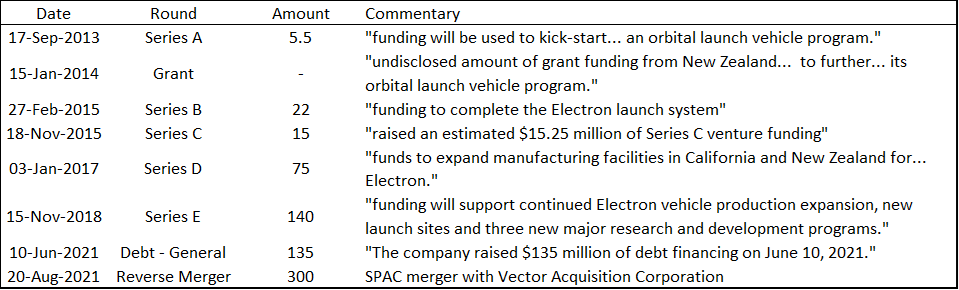

$180M for Electron development seems plausible – Rocket Lab raised $257M from 2013-2018 with $117M explicitly designated for Electron and $140M for Electron and “three new development programs”. The $140M was raised in late 2018, around when Electron announced Photon, the start of its space services pivot (or second act). $180M sounds low but is plausible based on publicly available figures. Thus, I model $180M of the $257M raised as Electron R&D, leaving $77M for other expenses like SG&A and Photon R&D/capex.

I allocate Beck’s $100M figure as R&D/capex from 2013-2020 and the remaining $80M as the cost to produce/launch the first 14 vehicles. R&D began in 2013 with a $5.5M Series A, which I allocate evenly across 2013-2014. I then allocate the remaining $94.5M in R&D/capex evenly across 2015-2020. It is unclear what Rocket Lab invested in Electron after Beck’s Oct 2020 $180M figure. Annual filings for 2023 and 2024 reference investment in “Electron’s first stage recovery”. It seems that Rocket Lab is now pivoting from Electron recovery into Neutron. For 2021-2025, I straight-line decrease R&D from its 2020 figure to zero.

SG&A

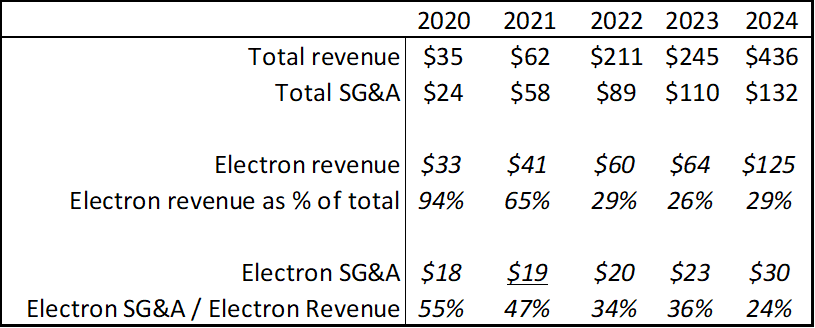

Program-level SG&A is a black box. Using public figures, I extrapolate Electron-specific SG&A for 2020-2024 proportionally with revenue. Electron SG&A = (Electron Revenue / Total Revenue) * Total SG&A * Reduction factor. I set 2021 SG&A as the midpoint between 2020 and 2022. 2021 had reduced revenue due to Covid-based launch delays that inflate that year’s Electron SG&A ($30M unadjusted, including 80% reduction).

I applied a reduction factor of 80% to the calculated SG&A. Electron SG&A as a function of Electron Revenue / Total Revenue certainly overstates true Electron SG&A spend. New programs have a much higher ratio of SG&A/Revenue. Electron is Rocket Lab’s oldest and most established program, and from 2020-2024, several new non-Electron initiatives began. It is likely that from 2020-2024, these other programs had an outsized influence on total SG&A/Revenue as these new and developing programs had little revenue but still required SG&A.

I first include SG&A in 2015 and assume that the R&D/Capex figures for 2013/2014 include it. As 2013/2014 capex is simply Rocket Lab’s entire 2013 capital raise divided by two, I think this is ok. From 2015 to 2019, I increase SG&A linearly to match its 2020 value. From 2020 to 2024, Electron SG&A / Electron revenue decreased as the program scaled.

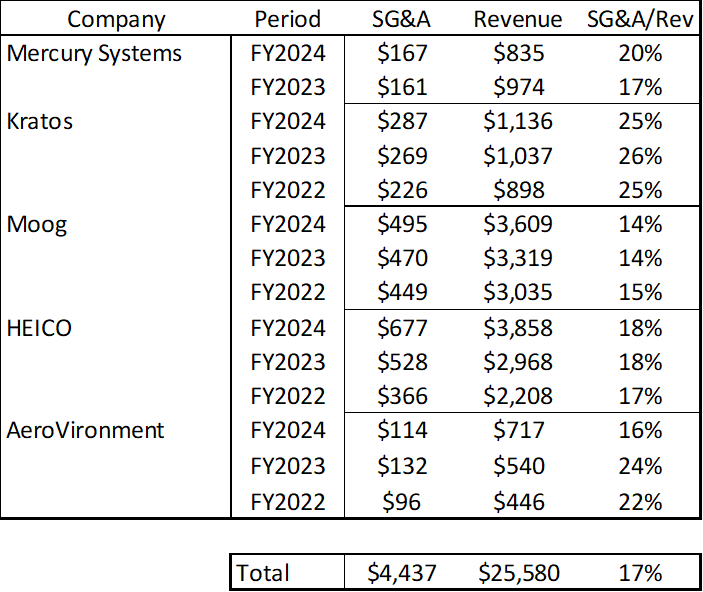

To project steady-state SG&A, I compiled SG&A as a function of revenue for five smaller aerospace firms. I linearly decrease SG&A over the next five years from 24% in 2024 to the comparable average, 17% and maintain SG&A at 17% beyond 2029.

Unit Costs

Rocket Lab has published Electron “cost value per launch” for 2020-2024. Rocket Lab claims the 2021 outlier to be driven by merger-related stock-based comp and “lower manufacturing absorption driven by COVID-19”. I am not certain whether the reported cost figure includes non-cash expenses like depreciation and amortization. I assume these non-cash expenses are not included.

I extrapolate 2017-2019 unit costs from Beck’s claim of $80M for the first 14 launches. Electron launched 10 times from 2017-2019 and 7 times in 2020. Of the first 14 launches, 4 were in 2020. $80M – 4*(2020 cost) = $54M. $54M/10 = $5.4M per flight.

I project 2025 unit cost as a function of frequency based on 2022-2024 cost/frequency data. Linear regression infers that Rocket Lab produces Electrons for $3.6M per unit and $36.1M in annual fixed costs. Cost/rocket = $36M/frequency + $3.6M.

Unit Revenue and Frequency

Rocket Lab has published Electron “revenue value per launch” for 2020-2024. The firm does not differentiate between HASTE and orbital missions, neither do I. I assume the 2017 test launch incurred no revenue, use the commonly cited figure of $7.5M/launch for 2018/2019, and use Rocket Lab’s published revenue/launch for 2020-2024. For 2025, I use an $8.4M figure Rocket Lab published in November 2024.

I differentiate between launch attempt and launch with revenue. I assume all launch attempts incur cost per launch, but only successful customer missions produce revenue. This excludes the 2017 test and failures in 2020, 2021, and 2023.

At the time of publishing, Rocket Lab completed 10 missions in 2025 with 18 planned this year. In August 2024, the same source cited 17 further Electron launches for the year, of which 7 occurred in 2024. In July 2023, the same source cited 10 further Electron launches, 4 occurred in 2023. I assume 41% (11/27) of projected 2025 launches will occur in 2025 for a total of 17 flights in 2025.

I really don’t feel like calculating weighted average cost of capital, so I used Citi’s reported WACC of 13% as my discount rate. All figures are nominal; I do not incorporate inflation and assume Citi’s WACC does.

Projecting Electron through 2035

This is where the fun begins! I get to make up numbers based on vibez.

In all seriousness, I may attempt to project the small-lift market in a future post. I also may build this model into a valuation model for $RKLB. I also may not! Quantitative modelling posts are significantly more time-intensive than vibe posts about strategy, so I may stick to more of those!

First, some assumptions. I assume 2023 was Electron’s last ka-boom and that the vehicle performs flawlessly into the future. Based on Falcon 9 failure rates, it seems reasonable to assume failures are insignificant. I assume no further R&D/capex and that “cost value per launch” includes maintenance capex (and that maintenance capex is not significantly bumpy). Rocket Lab has talked a lot in the past about weekly launch and I assume this is possible without significant capex. Furthermore, I assume Rocket Lab can scale to 200+ annual launches without significant R&D/capex by reusing Electron vehicles.

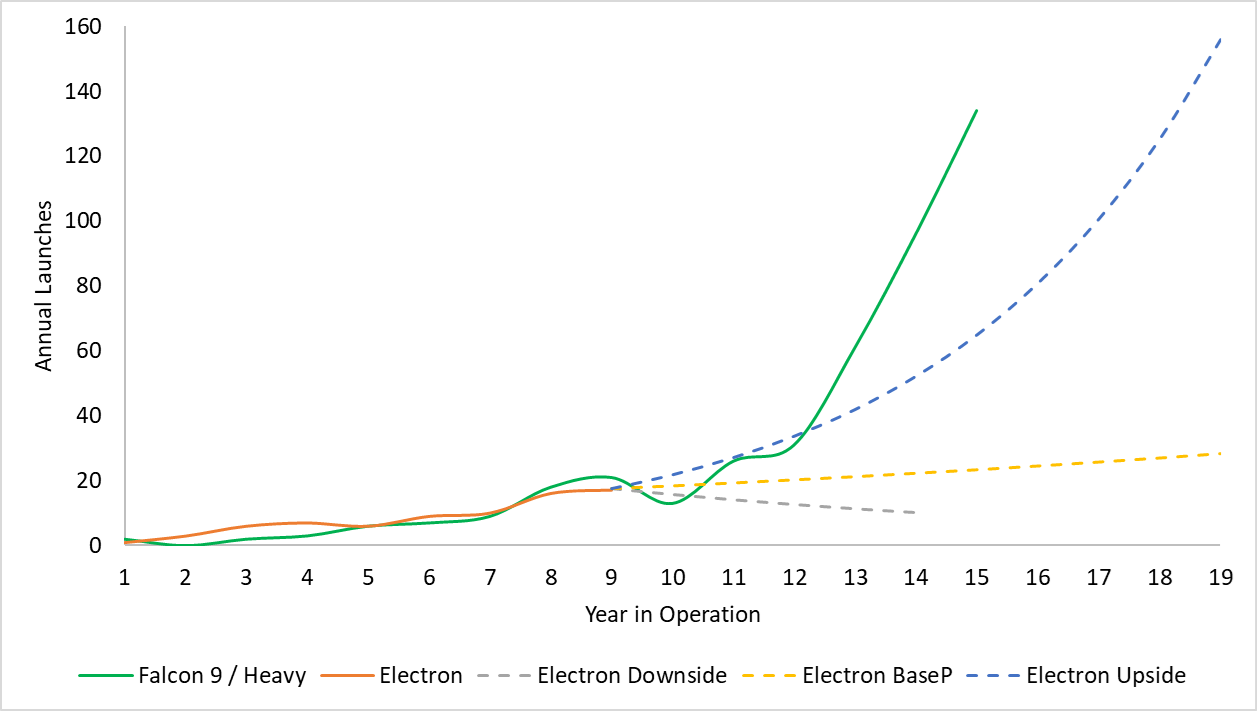

Base/BaseP: Dedicated launch remains a separate market from rideshare, few new small-lift launchers succeed, and small-lift demand growth offsets new supply. Slight frequency and price uplift. In base case, Electron operations cease in 2034. In the perpetual case, Electron operations continue indefinitely with gross profit slowing to 2% CAGR after 5 years.

Downside: New medium-lift competitors expand/improve rideshare, which eats dedicated small-lift and/or further small-lift launchers come online, eroding Electron’s flight frequency and pricing power. Rocket Lab cancels Electron at the end of 2030 as operational losses grow.

Upside: No competitors emerge, and small-lift demand increases to enable significant frequency uplift. Launch frequency grows at the 2022-2025 CAGR. Monopoly in dedicated small-lift enables pricing power and revenue/launch grows at the 2022-2025 CAGR. Past 2035, gross profit CAGR declines linearly to a perpetual rate of 2% in 5 years to track GDP growth.

I think some variation of the base case is most likely and assign 30% probability to each. Downside is more likely than upside (see my Astra post for thoughts on small-lift) and I assign probabilities accordingly. As stated above, this is all vibez with graphz to appear legit. I might do a deeper dive into small-lift supply/demand to map out a higher-fidelity perspective, but I’ll leave that for another day. Please disagree with me in the comments!

How much cash will Electron print?

The model above shows the perpetual base case. Below are results.

Concluding thoughts

I’ll admit, the title is a little click-baity. Obviously, Electron is worth it because it made Rocket Lab into a real new-space player and enabled Rocket Lab to expand into medium-lift and space systems. Electron may pay off financially, my base case NPV’s range from -$68M to $36M with a 13% discount rate.

I am really curious to hear your thoughts on any of my inputs or modelling decisions, particularly my future scenarios. I am downbeat overall on dedicated small-lift. You could approximate the current market as Rocket Lab’s Electron revenue, ~$150M, pretty small. However, if Electron is the market, the market is growing 34% annually (2022-2025 CAGR). How do you evaluate a small but rapidly growing market with powerful and growing substitutes (ride-share, emerging medium/heavy-lift rockets) and eminent competition (European launchers, American small-lift competitors)?

Competitors talk a lot about price, and price competition among small-lift providers could eradicate the sector’s thin profit margins. However, as first-mover and sole scale operator, Rocket Lab could conceivably weather the storm and maintain its leadership. Longer term prospects are even more unclear. What impact would an operational Starship have? As smallsat mass increases, how much of the market will Electron be capable of serving?

I hope you enjoyed this post! Please let me know what you think.

Revised 8/12/25 to include SG&A.