Is Astra back?

Astra's strategy, potential markets for Rocket 4, and the tyranny of the small-lift market

Intro

If you haven’t heard, Astra is back and pushing hard on Rocket 4. But why? Assuming R4 performs and production scales, is there even a market? I’m not convinced (per meme), but I would love to see them succeed…

Background

If you haven’t heard of Astra and/or are not familiar with small-lift, here’s a quick stylized primer. In the mid-late 2010’s, everybody thought SpaceX was cool and wanted to copy. Everybody had their own variation, but the basic idea was “get funding, build small rocket for small satellites, eventually build big rocket for big satellites and/or expand into other space products”. At one point, there were 100+ small-lift ventures.

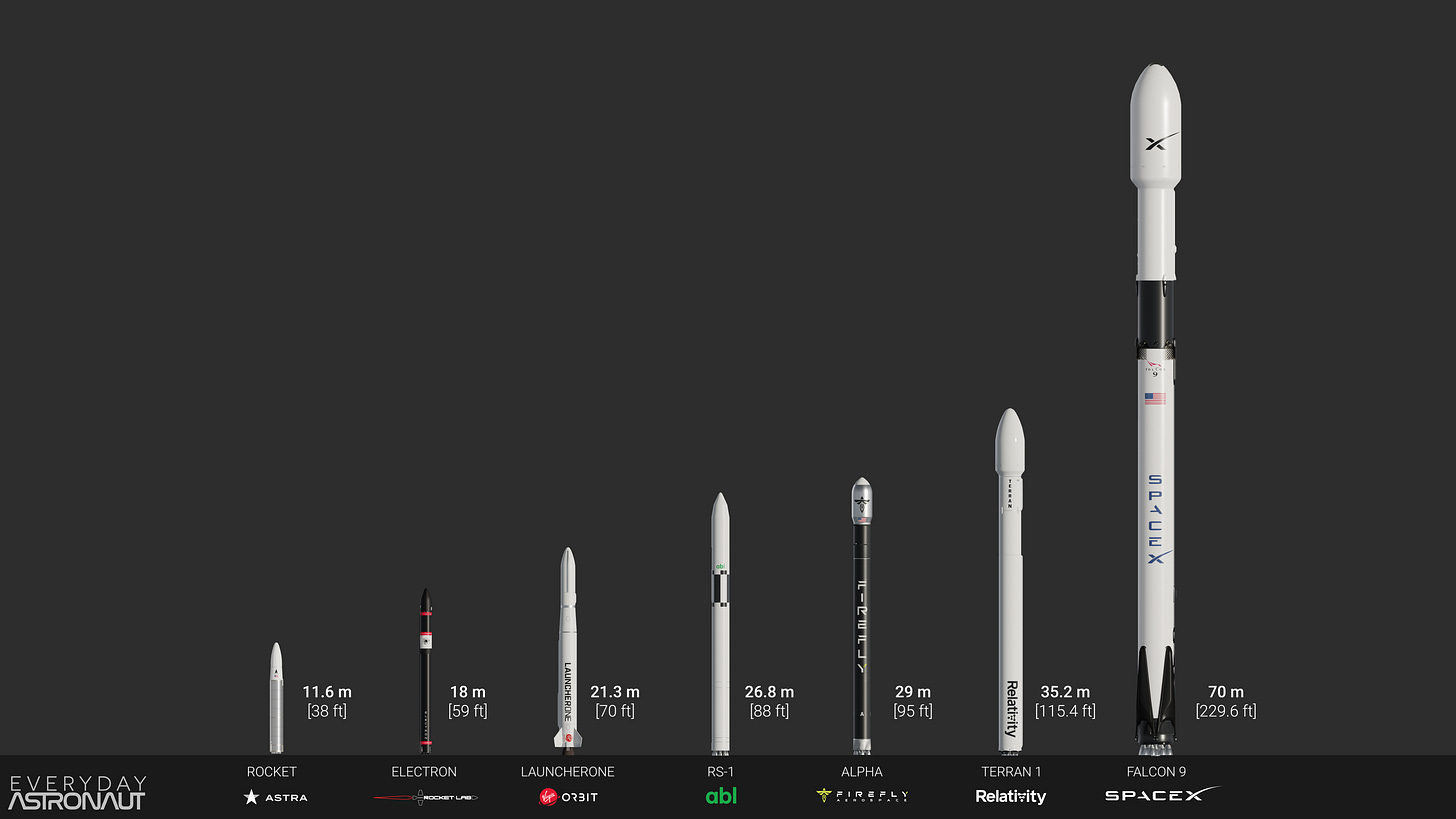

For context, the SpaceX Falcon 9 is medium-lift and lofts 22,000kg to low earth orbit (LEO). Rocket Lab’s small-lift Electron does 300kg, Astra’s Rocket 3 (also known as ‘Rocket’) below did ~100kg, and Astra’s Rocket 4 aspires for 600kg. Image below shows scale (source here, great small-lift primer).

One major problem with 100+ small-lift launchers was demand. At this point, overall launch demand was growing steadily and demand for small-lift was projected to skyrocket, with a common justification being unmet demand for upcoming mega constellations. Starlink was just the beginning, and many were announcing plans for 100, 1,000, or 10,000 satellite constellations in LEO. However, most of this demand never materialized for small launchers. Constellations either launched in-house (Starlink), launched with medium/heavy launchers (Kuiper, Oneweb), or failed (Rivada). The rise of rideshare (a bunch of smallsats sharing a medium/heavy rocket) ate a lot of demand from surviving LEO constellation ventures (Planet, Spire). For these reasons and others, most of these 100+ small-lift ventures failed or pivoted from small-lift to something else. Of the 6 small-lift launchers in the graphic above, only 2 still fly. The rest were cancelled via pivot (Astra, ABL, Relativity) or bankruptcy (Virgin Orbit).

Astra was one of these hot new small-lift ventures. Astra’s Rocket 3 was designed to loft ~100kg and aspired to launch daily. In 2021 Astra went public via SPAC at a valuation of $2.1B before a combination of failures and shifting markets brought them close to bankruptcy. In 2024, Astra’s co-founders took the firm private for ~$11M, concluding a 99.5% loss for early public investors. Quite the Free Fall, lol. But now, Astra is back and betting it all on Rocket 4.

Demand for Rocket 4

Per recent podcast appearances, Astra sees 3 markets for R4: 1) small-lift, 2) “anywhere” lift, and 3) Astra defense product. For this article, I define small-lift as LEO launch for commercial/government customers (presumably from a fixed location to reduce costs), anywhere-lift as LEO launch for government customers seeking domestic launch capacity, and Astra defense as Astra’s DIU Novel Responsive Space Delivery contract and the potential for R4 to essentially become a cost-effective, relocatable, liquid-fueled intercontinental ballistic missile/drone delivery vehicle. There is some conceptual overlap between anywhere-lift and defense; but I think differentiating between international LEO and DoD ICBM is helpful.

Astra has huge aspirations. On Valley of Depth, Kemp repeatedly affirmed “we are going to be more successful than a $16B company” [Rocket Lab]. To beat Rocket Lab, at least one of these three markets must be real.

1) Small Lift

To win small-lift, Astra needs to produce, find demand, and outcompete.

Produce: Kemp claims R4 will launch 600kg to LEO for $7500/kg, implying selling at $4.5M/rocket. For context, Rocket Lab’s cost to produce Electron (300kg to LEO) fell from $7.5M to $5.7M from 2022-24. Can Astra produce a rocket with 2x the capability for ~1/2 the cost while fitting it all within shipping containers? This seems unlikely, maybe possible with sufficient time and scale, but that requires copious demand.

Demand: Say Astra can produce to sell at $4.5M/rocket. Who will demand all these launches? In 2020 you could say “mega constellation” and investors would flock but demand kind of didn’t – planned mega constellations mostly launched in-house, via medium/heavy-lift, or never.

R4’s closest competitor, Electron, is currently demand-constrained. Is there a near-future where sufficient 600kg demand exists to enable scale production at less than $4.5M/rocket? Seems unlikely.

Compete: Competition is hard! Rocket Lab (300kg), Firefly (1000kg), Stoke (3000kg), upcoming European/Japanese launchers, SpaceX rideshare, others. Every other competitor abandoned small-lift as they saw no market!

Production, demand, and competition make small-lift a hard bet. Maybe small-lift isn't great. What about:

2) “Anywhere” lift

Technically, Kemp brands this "anything, anytime, anywhere" lift, however, anything isn’t necessarily true (600kg) and anytime isn’t necessarily unique (Firefly, Rocket Lab, SpaceX all offer rapid launch). The key is anywhere, the idea that sovereigns increasingly care about independent space access and will pay (more) for it. This may be true, but Astra is an American firm and major markets for this are already investing domestically (Europe, Japan, South Korea).

Firms like Astranis are showing that even non-traditional space nations seek sovereign capabilities, but will they pay up for sovereign launch? Would Taiwan pay more to launch its American-built satellite from Taiwan? Do sovereigns seek space launch or space capabilities?

It seems that nations seeking launch are developing it and nations seeking capabilities are finding them. I struggle to see demand abroad for US "anywhere" launch.

This leaves:

3) Defense

The idea that Astra could transport a 600kg payload to anywhere from anywhere is cool. But how real is the opportunity? In the best-case scenario where R4 works perfectly, beats space-delivery competitors, and surmounts the massive valley of defense funding death to achieve a major DoD Program of Record, how much of this value flows to Astra?

In the “rocket drone” case, Kemp stated both drones and reentry vehicles are outsourced. What is Astra’s cut as integrator? Is Astra the prime? Is Astra necessary? Can Astra pull this off while chasing the unattractive small-lift and anywhere-lift markets?

If Astra performs, locates funding, and the DoD values “launch anywhere” significantly more than fixed-site, maybe defense is a real market with demand and R4 monopoly potential. A lot has to go right, and the value of success is highly uncertain.

Conclusion

So what should Astra do? Is R4 worth it? Maybe it makes sense to claim that small/anywhere markets exist to raise money to chase defense. But why not just chase defense? ABL did it! Defense is hot, and management attention is finite, but Astra is focusing on small/anywhere-lift. On the hourlong Valley of Depth podcast, Astra’s CEO spoke a lot about launch but never got around to the Defense Innovation Unit contract.

Alternatively, Astra could abandon launch entirely and invest in building their spacecraft engine business into a component/bus/satellite supplier/producer. Sell picks and shovels into the goldrush of space! Rocket Lab, Redwire, and others have proven variations of the approach.

However, the skills for buy and build (valuation discipline, integration, market research/product-market fit) don’t necessarily overlap with Astra’s hard-tech team. Nor does Astra have a great track record of buying and integrating companies (see Apollo Fusion). Furthermore, this generally doesn’t achieve venture-scale returns and may not align with Astra’s investors…

In conclusion, I don’t think investing in R4 is worthwhile as no (attractive) market exists. Small-lift is small and competitive, anywhere-lift doesn’t exist and probably won’t, and defense is ill-defined and difficult. I hope Astra proves me wrong! Let me know what you think.